USA Selected Domestic Asset Protection Trusts & Self-Settled Spendthrift Trusts Explained

Project Porcupine – Make Yourself and Your Assets Appear Unappetizing As A Porcupine – Using Trusts for Everyday People Trying To Make It Harder To Be Victimized By Scammers, Thieves, and Opportunists. Make 2025 The Year Of Personal Protection In Unsettled Times.

Project Porcupine is an effort to make yourself and your assets unappetizing to people who would take advantage of your good nature or who would try to “shake you down” for a quick payment. You may well have an idea who they are in your life. Business owners who operate outside the USA should consider that Project Porcupine makes you, your family, and your business an unappealing target for kidnappers, extortionists, and other bad actors. Business owners included here are the “high-risk” occupations which are single owner-operated businesses in the benefits of asset protection.1 Project Porcupine is the best alternative.

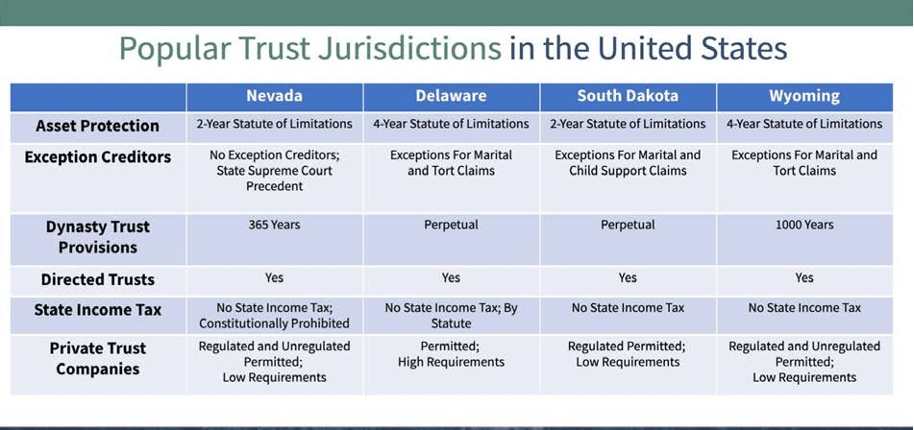

Project Porcupine uses trusts to protect business and personal assets. In particular, trusts that allow the owner (“settlor”) to have use of the assets, obtain cash as needed, and exercise substantially all the controls as if held in his or her own name. This form of trust is a Domestic Asset Protection Trust (“DAPT”), a “grantor trust” that protects assets from creditors while allowing the person who set up the trust (a settlor or grantor of the trust) to be in control (mostly) and to benefit from the assets including the properties, cash, and other items of value held in the name of the trust.Nevada is one of four (4) States with such trusts2 and favorable tax laws. Nevada has the advantage over the others because its laws shorten the time within which a creditor may sue to collect assets within the ownership of the trust.

An Asset Protection Trust helps legally protect assets from creditor

claims without putting the settlor or the beneficiary in violation of laws concerning tax evasion and asset concealment.3 Commonly, State laws allow anyone who is competent to execute a will to create a trust for asset protection. Usually, individuals in high-risk of litigation or risk of loss professions establish DAPTs.4

Based upon experience and several expressed reasons here the State of Nevada presents the best package of DAPT laws for a settlor to consider when forming such a trust.

- Positive Aspects – The best features of the Nevada Domestic Asset Protection Trusts are as follows (“NDAPT”):

- The trust structure must be “irrevocable” as defined by law.5 All powers reserved to the settlor of the trust must be clearly laid out in the trust document(s).6

- The statute requires the trustee or at least one independent co- trustee to be a Nevada resident or a Nevada financial institution with trust powers.7 State statutes require the use of an “independent trustee” before distributions can be made to the grantor.8

- Trustees are immune from claims of collusion and other nefarious charges merely for being the trustee unless the claims prove by “clear and convincing evidence” that the trustee (or advisor) “knowingly and in bad faith violated Nevada law” and through those specific actions caused damage to the person claiming injury.

- Nevada allows for directed trusts, which enable the settlor to name him/herself or an independent financial advisor to manage the funds of the trust. However, a NDAPT cannot require the income or principal of a NDAPT to be distributed to the settlor.9

- Nevada allows for the settlor to grant the authority to him/herself to use real or personal property of the NDAPT, hold lifetime or testamentary limited powers over trustee appointments, removal and replacement, and execute other management powers normally reserved for trustees.

- Nevada does not tax the income of trusts. Nevada doesn’t have any estate or inheritance taxes. Federal taxes still apply after the exception amount.10

- A non-resident alien is subject to a 40% estate tax on all US assets upon death, however the trust avoids these taxes. You do not have to live in Nevada to take advantage of a Nevada Asset Protection Trust.

- There are no exceptions which would allow a creditor (including a divorcing spouse) to reach the trust assets.11

- The assets are secure from the claims of creditors after the statute of limitations of two years from the date of transfer, or for an existing creditor, six months after the creditor discovers or reasonably should have discovered the transfer, whichever is the latter.12

The Nevada DAPTs have been in existence for more than 20 years, and domestic asset protection trusts are legal in 17 other States in the United States. Yet, there are several risks to asset protect that remain after all this time.

One risk is that the cash, securities and tangible property placed into the Nevada trust will not be safe there from all creditors. This fear doesn’t attach to Nevada assets placed into a Nevada trust. The fear attaches to assets contributed to the NDAPT by the settlor but which are physically located in another State (a non- DAPT State). There is not enough history of legal opinions addressing whether a DAPT will, for a fact, be upheld to protect from creditors the assets transferred into the DAPT. For example, the vacation home in Hawaii when transferred into the name of the NDAPT by the settlor is still a house in Hawaii. A court in Hawaii can determine that the transfer by the settlor violated State laws against transfers if a creditor brings an action. But compare, if the settlor transfers mineral rights in Wyoming to the NDAPT, and a similar effort by a creditor were made to unwind the ownership transfer the outcome is most certainly going to respect the Nevada trust laws since Wyoming is one of the other DAPT respecting States. The same analysis occurs for cash, securities and other “moveable” property (i.e., vehicles, livestock, art).

Even while adhering to these requirements, the Asset Protection Trust can still be structured for maximum flexibility by including the following features:

- Investment Control: The settlor can serve as the investment trustee, allowing the settlor to make all investment decisions, as long as this role is limited so that the settlor cannot make distributions to himself or herself without the approval of another person. This feature is also helpful to satisfy the Nevada trustee requirement, as most clients are leery of handing over investment control and will elect to serve as the investment trustee. If the settlor of a Nevada DAPT declines to act as the “investment trustee,” then another Nevada resident, Nevada trust company or Nevada bank can serve as one of the required trustees to utilize Nevada’s favorable laws. Other States have similar provisions.

- Veto Power: The settlor can retain a veto power, allowing the settlor to override any distributions that the distribution trustee has authorized. This feature gives the settlor security, knowing that regardless of the authorized distributions, the settlor has the power to reject a distribution. Plus, if the settlor chooses to act as the investment trustee (and the distribution trustee’s powers are limited), the settlor will be the only person making the actual transfers (after receiving authorization from the distribution trustee to do so), as he or she is the only trustee who holds any signatory powers on the trust accounts.

- Power of Appointment: A settlor can be granted a broad special power of appointment, essentially allowing the settlor to make a distribution to a beneficiary other than the settlor or to rewrite the terms of the trust. This feature is helpful when it comes to adapting to changing circumstances, such as family situations and tax laws.

- Power to Remove and Replace Trustees: The settlor can retain the power to remove and replace trustees if a change is desired, providing the settlor the comfort of knowing the appointed trustees can be replaced.

- Power to Use Trust Assets: A settlor who is also a trust beneficiary is permitted by statute to use property held by the NDAPT without having to pay rent to the NDAPT. This feature allows the real or personal property held by the NDAPT to be used by the beneficiaries while it remains protected in the NDAPT rather than requiring it to be distributed out from the NDAPT, thereby exposing it to creditors.

Cost vs Benefit Analysis – There is usually an internal discussion with the settlor about “how much is this going to cost” and with all things important and satisfying the answer is “more than you like but less than you expect.” Aside from attorneys’ fees, bank charges, and the trust registration fees for transferring assets into the trust, some assets might require fees for changing the name on the title deed, registration, or license. Also, some trustees charge a minimum fee, a transaction fee for services, and even a percentage of the trust’s asset value (in certain circumstances). The coordination of the tax professionals and the lawyers drafting the trust is not a readily measured quantum at the time of engagement so both accountant and lawyer may well seek something like a combination of a “flat” fee and an “hourly” fee for this work.

Costs for regulatory compliance are also internal to the settlor’s company, family office, or personally. Managing the trust as a trustee imposes costs occasionally not recognized initially through the settlor’s need to change practices to conform with the law. Typically, for example, a settlor acting as trustee may wish to wire money from the bank – however – the rules require the independent trustee to approve the movement of money and thus the wire from the bank (usually the independent trustee is on the bank account). This new “culture” can take a while to get organized and integrated into the standard operating processes.

Costs To Control – Further cost elements may include the following:

Generally, the IRS says that if the grantor creates a trust and retains all benefit of the trust property for his or herself,

- The Independent Trustee – The independent trustee is a cost center which will be new to the settlor. There is a fee for the time of the independent trustee to review and approve all payments from trust accounts and there is paperwork (always) required to establish the payment is in the interest of the trust. This type of bureaucracy is usually new to the settlor and takes time to become routine, and costs fees for each distribution as a result. The pace and lack of autonomy is usually the most frustrating part of the change to the DAPT. For example if using a Nevada DAPT then finding a Nevada resident to act as the independent trustee is one alternative to hiring a professional trustee for cost and convenience. However, the Nevada resident may well not aid the settlor in maintaining the “formalities” necessary for successful compliance with the law. Less common are lawyers who agree to serve as the independent trustee because they can get sued or receive Bar Association complaints for which there is no indemnity from the trust. Negotiating a package of services from the professional trustee companies is the better approach for the settlor.

- Tax Professionals – The accounting and tax preparation fees should be expected for items little (i.e., obtaining the tax payer number for the trust) to large (i.e., booking the basis and present values of assets that are contributed to the trust). The setting up of books, chart of accounts, and building the journal entries is time consuming even with the benefit of software (maybe AI aided can reduce costs). The maintenance of the asset registers and the justifications of disbursements from the trust assets requires routine accounting attention to detail including tying the distributions back to the intention statements in the trust documentation. The amount of the new expense will be in direct relationship to how well organized the settlor’s books are at the time of action, and how easily the settlor can build a standard operating procedure to tie the electronic accounting system transactions to the trust’s stated intent.

- Generally, the IRS says that if the grantor creates a trust and retains all benefit of the trust property for his or herself, then the trust is a disregarded entity. Even though the trust may legally own the trust property, the IRS treats that grantor as the real owner of the property.13 The settlor usually wants a specific tax treatment for the trust and the assets moved into the trust

- There are also tax consequences relating to the “reversionary interests” and to the exact type of “administrative powers” retained by the settlor as set forth in the trust document(s).

- There are tax consequences found in shifting the financial nexus of the business or the assets to a sales tax jurisdiction (such as Nevada) and these costs also need to be evaluated and compliance with the taxing regime planned.14

The tax professionals, accountants, and the lawyers need to all be engaged at some level to help the settlor with selection of jurisdiction(s)15 and compliance mechanics.

- Legal Professionals & Transaction Advisors – The attorneys fees and transaction advisor fees are usually “front end loaded” if the trust is set up and the corpus is funded from the first day. There are some situations where funding the trust is delayed or even deferred for future events. However, the opportunity for failure (i.e., forgetting to transfer assets intended for the trust or for which trust cash or value is expended to support without the asset being inside the trust) usually urges the settlor and the lawyers to move expeditiously through formation to operation.

- The fee for drawing up the trust document(s) is usually related to the magnitude of the malpractice exposure than it is measured by the hours spent as a draftsman. Many basic trust documents are already in “form” conditions and the time to fill in blanks is deceptively short. However, discussions by the settlor and the lawyer about selecting the jurisdiction and form of trust or methods of transfer can take a substantial amount of discussion. For example, privacy concerns about resisting public disclosure of the trustees or beneficiaries, or tax concerns for the operations and earnings of the assets, or the weighing of the creditor protections (statute of limitations) of the assets under a particular set of laws – these are a handful of the legal issues that should be discussed within the “documentation phase” of the engagement.16

- Some settlors may be concerned about making transfers of assets into the trust from a State that doesn’t respect these types of asset protection trusts. A work-around for the settlors of the DAPT may be establishing a “Hybrid-DAPT” address the fears of asset transfers (or being a resident of) a non-DAPT jurisdictions The form is a basic DAPT with a third party settlor (either nominee or attorney) or (in the

alternative) with the settlor not a named as an express beneficiary at the time of formation. 17

- The settlor should reasonably expect to pay a “flat fee” for the trust documentation, and a separate (usually hourly) fee for the transfer documentation that accompanies each asset transferred into the trust and a series of other regulatory compliance issues which usually fall into the lawyer’s scope of work. An experienced attorney will be able to provide a “maximum price guarantee” for the entire program if asked. The written representation agreement must have a defined “scope of the representation” which should be expected to clearly separate the tasks for which the fees are either “flat” or “hourly.”

- Occasionally, the flat fees for the trust documentation may appear large relative to the eight or more pages of the average DAPT. In this instance size doesn’t matter – quality and risk management matter. The rationale for the fee is that the documentation reflects the benefit (through brevity) of the experience of the lawyer engaged, and the measure of “risk” that lawyer assumes by preparing the trust which is “irrevocable” (and that word means what it says). The lawyers who document a trust can be expected to charge more and to take more unseen steps to assure the settlor and themselves that the (1) trust reflects all the intent and plans for the predictable uncertainties of life; and (2) that the assets moved into the trust are transferred properly and with the full understanding (“informed consent”) of the settlor. Failures in the either of these steps could leave a chaotic gap in trust administration or leave the trust assets vulnerable to a creditor claim. Lawyers will insist that the fee for service reflects the level of risk in a future lawsuit for some defect in the transaction.

- The hourly fees for the asset transfer and other work outside of the trust document itself will necessarily include the State specific transfer documentation for the assets, and extensive discussions with the accounting and tax professionals to reach the valuations required to establish the tax basis among other details. In some instances, a federal tax opinion may be required for a transaction which is either contemplated or conceived. In other instances lawyers will review and advise the settlor on federal compliance issues such as the Corporate Transparency Act (“CTA”) which will require disclosure of the beneficial ownership to the Financial Crimes Enforcement Network (“FinCEN”).” The settlor should be prepared to negotiate the hourly fee structure with the lawyer understanding these very important issues are less apparent to the non- professional.

The degree of consultation and coordination of the professionals should be more apparent in this described context. Consider seeking a Guaranteed Maximum Price for the entire scope of work as a way to manage costs and expectations.

An experienced lawyer should be able to offer such a concession.

Why Now ? – There is no time like the present for planning and budgeting the asset protection plans for the coming year. The exposure to risk has not necessarily increased on a global level but the amount of wealth you have exposed to that risk may have increased over the last year(s). The international reports on crime and poverty make clear that crimes of violence (including kidnapping) are on the rise in both developed and developing countries. The World Bank reports that the rate of reduction of global poverty has shrunk to almost one half of one percent (.06%) and the rate of consolidation of wealth in the richest 1% has risen to account for half of the total income in the world. The richest .01% has increased its possession of global wealth from 8% three decades ago to 12% today according to the International Monetary Fund. The global population has grown to 8.2 billion people and will reach 10.4 billion by 2080 despite industrialized nations experiencing a decline in birth rates (below replacement levels) in this same time period according to the United Nations.

The totality of the global environment recommends to the prudent business person to begin migrating assets into more secure protective structures which offer continued use of the assets with no substantive tax consequences. Project Porcupine is worth considering now.

Reference List

- Nevada Self-Settled Spendthrift Trusts and NDAPT sources:

- Internal Revenue Code, Grantor Trust Rules:

- Nevada Sales & Use Tax Rates:

- Wyoming Sales Tax Rate Information:

- South Dakota Sales & Use Tax Info:

- Delaware Gross Receipts Tax:

- Case law reference:

- Klabacka v. Nelson, 133 Nev. 164, 394 P.3d 940 (2017)

- Journal citation:

- McCandless, C., Nevada Lawyer, December 2018